Why a business insurance agent abilene tx is key to financial security

Wiki Article

Everything about Insurance: Necessary Insights for Savvy Consumers

Insurance plays a pivotal duty in economic stability and threat monitoring. Customers often forget the nuances of numerous kinds of coverage, leading to misconceptions and prospective voids in security. False impressions can shadow judgment, making it necessary to review personal demands and choices seriously. Understanding these aspects can greatly influence economic wellness. Several stay not aware of the techniques that can enhance their insurance selections. What understandings could reshape their approach?Understanding Different Kinds Of Insurance

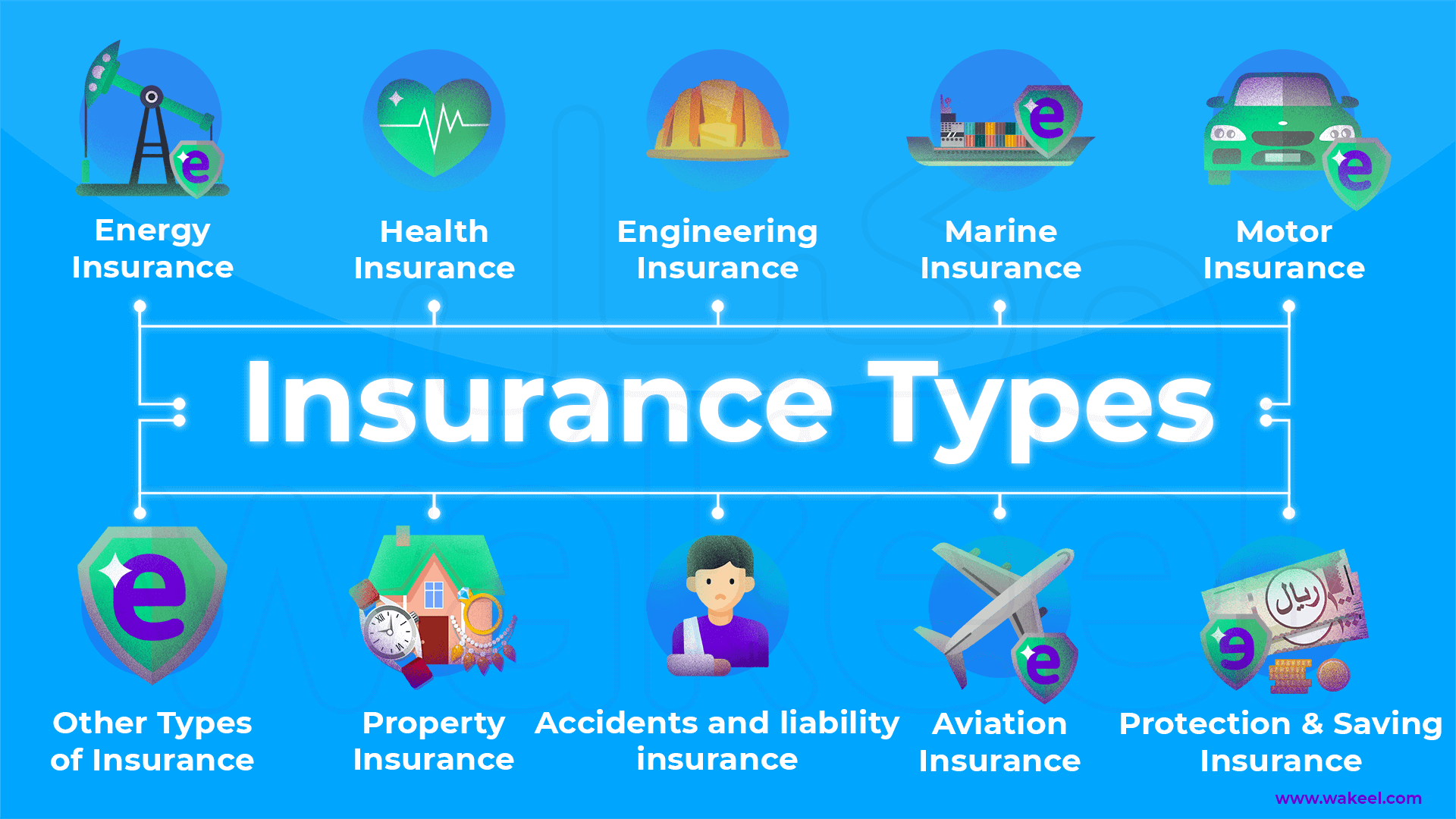

What kinds of insurance should consumers take into consideration to safeguard their assets and health? Different types of insurance play an essential role in securing people and their properties. Health insurance is necessary for covering medical expenses, ensuring access to necessary treatments without monetary concern. Home owners insurance shields versus damages to residential property and responsibility cases, while tenants insurance offers comparable protection for occupants. Car insurance is mandated in several places and covers vehicle-related events, giving economic safety in situation of accidents or burglary.Life insurance policy serves as an economic security web for dependents in case of a policyholder's fatality, helping protect their future. Impairment insurance is vital for income protection during extended illness or injury, permitting individuals to maintain a requirement of living. Finally, umbrella insurance uses extra obligation insurance coverage past standard plans, providing an extra layer of defense against unpredicted circumstances. Each type of insurance addresses specific dangers, making it important for customers to assess their personal needs.

Usual Misconceptions Regarding Insurance

How commonly do consumers find themselves misleaded about insurance? Many individuals nurture false impressions that can bring about poor decisions. A prevalent myth is that all insurance coverage are the very same, which ignores vital differences in protection, exclusions, and costs. Another typical idea is that insurance is unnecessary for young, healthy people; nonetheless, unanticipated occasions can take place at any age. Additionally, some customers believe suing will immediately bring about higher costs, which is not constantly the instance, as this differs by insurance firm and specific conditions. Moreover, numerous think that having insurance indicates they are fully safeguarded against all possible dangers, yet policies often have constraints and exemptions. These false impressions can cause insufficient insurance coverage or economic pressure. It is important for consumers to inform themselves about insurance to make enlightened choices and stay clear of risks that originate from misconstruing their policies.

Analyzing Your Insurance Requirements

When determining insurance demands, customers frequently question where to begin (business insurance agent abilene tx). An extensive analysis starts with assessing personal circumstances, including economic standing, properties, and potential obligations. This involves recognizing what requires protection-- such as wellness, residential property, and revenue-- additional hints and understanding the risks related to eachNext off, consumers should consider their existing insurance coverage and any gaps that may exist. Reviewing existing policies helps highlight areas that need added protection or modifications. Furthermore, life modifications, such as marriage, home purchases, or parenthood, can greatly modify insurance needs.

Engaging with insurance experts is also suggested, as they can offer tailored guidance based on individual situations. Eventually, the goal is to create a well-shaped insurance profile that lines up with individual goals and uses assurance versus unexpected events. By taking these actions, customers can establish they are properly safeguarded without exhausting their financial resources.

Tips for Selecting the Right Protection

Choosing the best coverage can usually feel frustrating, yet comprehending essential variables can simplify the procedure. Customers should begin by reviewing their details requirements, taking into consideration aspects like individual possessions, health and wellness status, and lifestyle. It is important to research study different sorts of coverage readily available, such as obligation, comprehensive, or collision, making certain that each alternative lines up with individual situations.

Cost contrasts among numerous insurance providers can expose considerable differences in costs and coverage limitations. Looking for quotes from numerous insurance providers can aid recognize the most effective view publisher site value. In addition, customers should examine policy terms closely, focusing on exclusions and deductibles, as these elements can affect total defense.

Consulting with an insurance coverage representative can use individualized insights, ensuring that people are not ignoring vital components. Ultimately, making the effort to analyze choices thoroughly results in informed choices, providing satisfaction and ideal coverage customized to one's distinct situation.

The Significance of Frequently Assessing Your Plans

Regularly assessing insurance policies is essential for preserving appropriate insurance coverage as individual situations and market problems change. independent insurance agent abilene tx. Life occasions such as marriage, the birth of a child, or modifications in employment can considerably impact protection requirements. In addition, changes in the marketplace, such as rises in premiums or new plan offerings, might offer much better choicesCustomers ought to establish a timetable, ideally yearly, to analyze their policies. This procedure allows individuals to determine spaces in coverage, confirm restrictions suffice, and get rid of unnecessary policies that might no longer offer their requirements. Examining plans can lead to possible savings, as customers might find discount rates or lower costs offered with changes.

Inevitably, positive review of insurance plan equips customers to make educated choices, guaranteeing their insurance coverage straightens with their existing way of living and financial scenario. This persistance not just improves defense however also promotes monetary tranquility of mind.

Frequently Asked Questions

How Can I Sue With My Insurance copyright?

To sue with an insurance policy service provider, one typically requires to contact the business directly, give necessary documents, and follow the details treatments detailed in their policy. Timeliness and precision are essential for successful cases processing.What Variables Impact My Insurance Costs?

Different factors affect insurance costs, consisting of the insured individual's age, health status, area, sort of insurance find out here now coverage, claims history, and credit rating. Insurance providers examine these aspects to identify threat levels and suitable premium rates.Can I Change My Protection Mid-Policy Term?

Changing coverage mid-policy term is usually possible - abilene insurance agency. Insurance providers commonly enable changes, affecting premiums appropriately. Insurance holders ought to consult their insurance supplier to comprehend particular terms, ramifications, and possible expenses connected with modifying their insurance coverage throughout the policy periodWhat Should I Do if My Case Is Refuted?

Are There Discount Rates for Packing Several Insurance Policies?

Several insurance carriers supply price cuts for bundling several plans, such as home and auto insurance. This technique can lead to significant cost savings, encouraging consumers to settle insurance coverage with a single insurer for convenience and price.Report this wiki page